AI projects in insurance often stall. Here's why:

Legacy systems slow down integration

Manual workflows are difficult to unlearn, increasing claims cycle time

Underwriters lack predictive tools for risk scoring

Compliance concerns block innovation

Your team is stretched thin, or doesn't have full stack development skills

Stakeholders demand faster ROI than pilots can show

Sound familiar? Let's fix this together.

What we build

Practical AI that's built for regulated industries like insurance

At Lean Innovation Labs, we help insurance companies turn high-stakes ideas into usable, secure AI solutions—fast. Our team combines deep enterprise experience with lean development to prototype, deploy, and scale tools your teams will actually use.

Claims automation & processing

Speed up approvals and reduce cycle times with intelligent workflow automation.

Predictive underwriting

Train models to score risk faster using your proprietary data—no black box models.

Document analysis & summarization

Use AI to process, extract, and summarize key insights from policy PDFs and loss forms.

AI risk assessment

Run real-time risk evaluations with structured outputs and traceable logic.

Customer service bots & AI powered knowledge base

Reduce ticket volume with bots trained on your documents, policy language, and past claims.

Insurance fraud detection AI

Identify anomalous behavior and patterns without relying on rigid rule-based flags.

How we work

Our Lean7 development methodology

A practical, 7-step framework for designing and deploying AI agents that deliver measurable business impact.

Step 1

Define core value & KPIs

Anchor every agent in a measurable outcome—before we touch code.

KPIs

Step 2

Design for the problem

Choose the right tech and UX to solve a real task, not chase hype.

Step 3

Identify compliance guardrails

Solve security, privacy, and legal blockers up front.

Analyzing current workflow..

Step 4

Integrate into workflows

Build agents into your team's existing tools and processes.

Our Solution

Your stack

Step 5

Create an evaluation framework

Test for accuracy, reliability, and alignment from day one.

Step 6

Develop + deploy

Build rapidly using proven blueprints—production-ready from the start.

< / >

Step 7

Establish a feedback loop

Use real data to monitor, improve, and evolve your agent in production.

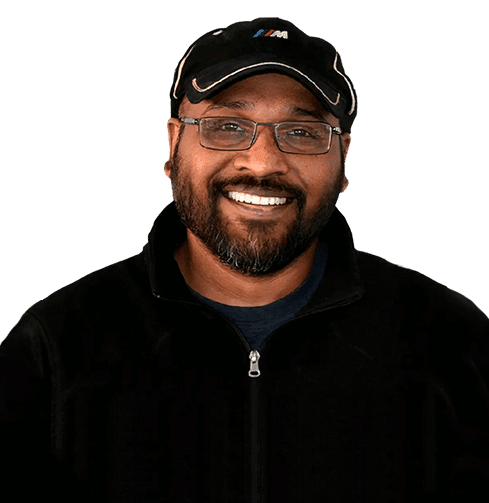

About Us

Full-stack AI development firm based just outside Washington, DC

We bring deep expertise across AI, data, cloud, and compliance—trusted by SaaS, fintech, and federal teams to build secure systems.

Swipe the top photo left or right.

Benefits

Why choose

Lean Innovation Labs

Discover the key benefits to partnering with us

Proven agent architecture accelerates delivery

Benefit

Security and compliance baked in

Benefit

Full-stack engineering talent across AI, data, and UX, led by seasoned leaders

Benefit

10+ year track record across federal, fintech, and enterprise SaaS clients

Benefit

The thoughtfulness of the Lean Innovation Labs team is impressive. When building our conversational AI agent and multi-agent platform, they really spent the time to think through the design.

Bala Balabaskaran

CTO

Ready to build responsibly with AI?

Schedule your call below.

FAQ

Frequently Asked Questions

A few questions about AI development services for insurance companies.

Yes. We design solutions that work alongside your current tech stack, not against it.

Security and compliance are built into every step—HIPAA, SOC2, audit trails, and data access policies are standard practice.

Our AI Accelerator is a 6-week engagement priced at $20,000 with clear deliverables and no long-term lock-in.

You get a production roadmap and can choose to keep working with us—or take it in-house.

Absolutely. We've built document analysis tools for real-world data—including policy forms, claims PDFs, and scanned loss statements.